How Much Money Do You Need to Start Investing in the Stock Market?

Picture this: You’re at a bustling farmer’s market. You’re surrounded by stalls selling fruits, vegetables, and artisanal products. Would you grab the first apple you see without checking its quality or comparing prices? Probably not. The same principle applies to choosing stocks.

Here’s something that might surprise you – how much money do you need to start investing is far less than you might think. That old belief about needing thousands of dollars? It’s as outdated as a flip phone. Today, you can begin your investment journey with just $25 a week. Most online brokers have thrown out their minimum account requirements, swinging the doors wide open for everyday investors like you and me.

But let’s be honest – having money to invest isn’t the biggest hurdle. The real challenge? Knowing what to do with that money. It’s like having all the ingredients for a gourmet meal but no recipe to follow. No wonder 58% of Americans are expected to turn to robo-advisors by 2025 to help guide their investment decisions.

Think of this guide as your investment roadmap. Whether you’ve got $25 or $1,000 to invest, we’ll explore exactly how to put that money to work. No fancy jargon, no complex theories – just practical, proven strategies that real people use to build wealth through stocks.

Can You Start Investing with Less Than $100?

Don’t try to catch a falling knife – that’s what my first investment mentor told me. In other words, avoid trying to time the market perfectly. Starting with less than $100 might feel like bringing a spoon to a feast, but here’s the beauty of it – that small spoon can fill up quite a bowl over time.

Even if you’re wondering how much money you need to start investing, the truth is: with under $100, quality investments are already within reach. Companies like Novo Nordisk (around $83) and Carnival offer shares at reasonable price points. But remember – buying individual stocks is like putting all your eggs in a very small basket.

Let’s talk about your new best friends – low-cost index funds. Think of them as buying a slice of the entire market pie instead of hunting for the perfect apple. Two standout options that won’t eat up your returns with fees:

- SPDR Portfolio S&P 500 ETF (expense ratio: 0.02%)

- Fidelity ZERO Total Market Index Fund (expense ratio: 0%)

These funds let you own tiny pieces of hundreds, even thousands of companies. It’s like having a miniature business empire in your pocket!

Pro Tip: Dollar-cost averaging is your secret weapon here. Picture it like filling up your car – instead of trying to guess when gas prices will be lowest, you put in $25 worth every week. Here’s how it works:

- Pick an amount you won’t miss (maybe $25 weekly)

- Invest it religiously, rain or shine

- Buy more shares when prices drop, fewer when they rise

So now you know how much money you need to start investing – the next step is simply taking action. Fear and greed are like backseat drivers, always trying to grab the wheel. Don’t let them take control.

What’s the Best Way to Invest $500?

Diversification is like a financial safety net. Without it, you’re just one bad investment away from a financial face-plant. With $100–$500, you’re ready to weave that safety net properly.

Think of your portfolio like a well-balanced meal. You wouldn’t eat just protein or only carbohydrates, would you? The same goes for your investments. A healthy portfolio needs different ingredients that don’t all move in the same direction.

Many investors still ask, how much money do you need to start investing seriously? The answer is: even $500 can get you started on a solid, diversified foundation.

A simple yet powerful recipe: put 90% in low-fee stock index funds and 10% in short-term government bonds. For younger investors, an 80/20 split between stocks and bonds might make more sense. It’s like having a shock absorber for your investment vehicle – enough cushion to smooth out the bumps without sacrificing too much speed.

Keep your portfolio simple but smart. Here’s a four-course investment meal:

- Domestic stock fund (Vanguard S&P 500 ETF – your main course)

- International stock fund (your side dish of global growth)

- Domestic bond fund (your financial vegetables)

- International bond fund (exotic spices for extra flavor)

This combination gives you exposure to different markets. The beauty of an S&P 500 fund? One purchase gets you a slice of 500 American corporate giants. It’s like buying a ready-made business empire!

If you’re itching to pick individual stocks, keep it to 5–10% of your portfolio. Think of it as your dessert – enjoyable but not the main meal.

Advanced Strategies When Investing $1,000 or More

Remember that feeling when you first learned to ride a bike without training wheels? That’s what investing $1,000 or more feels like – exciting and slightly nerve-wracking, but full of possibility. Your financial training wheels are off, and it’s time to explore some sophisticated moves.

Warren Buffett keeps things remarkably simple even at this level. His famous 90/10 strategy puts 90% into a low-cost S&P 500 index fund and 10% into short-term government bonds. It’s like having a well-built house with solid insurance – you get both growth potential and protection.

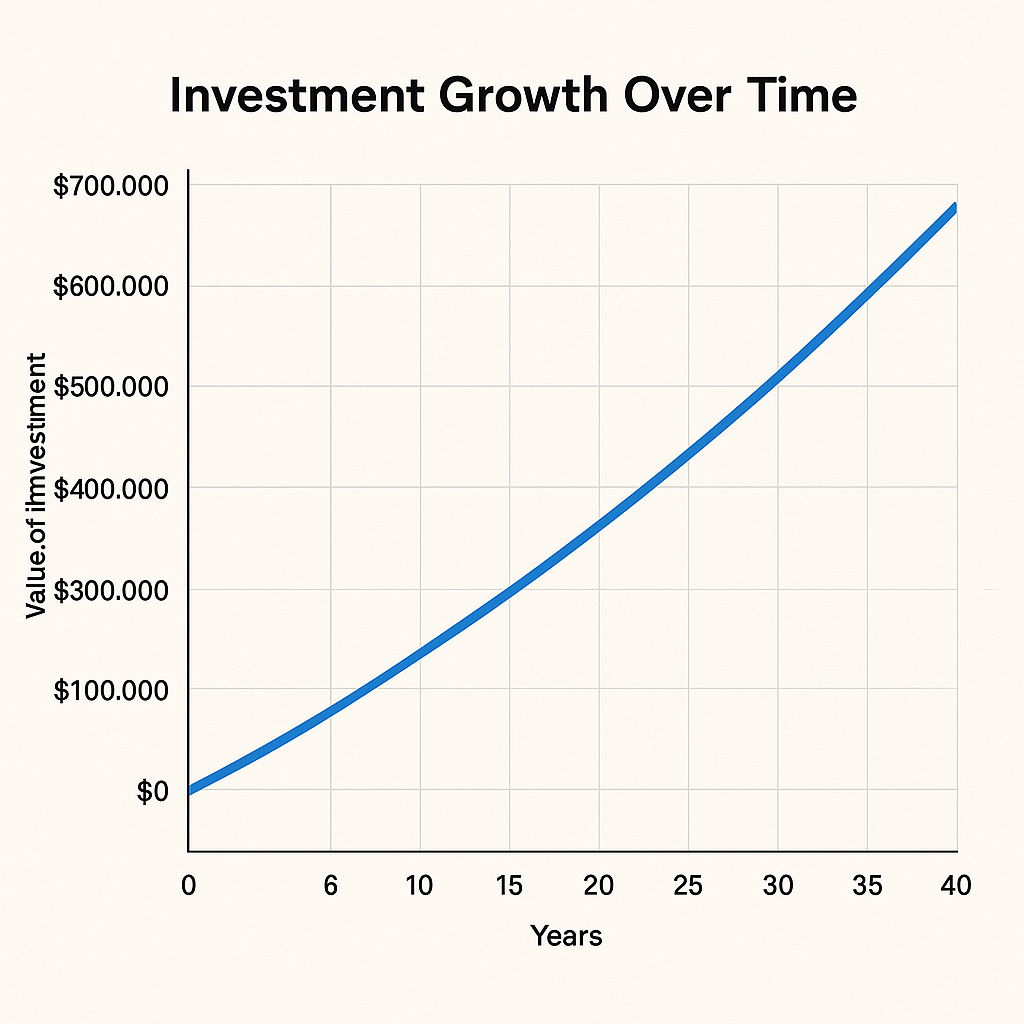

Think about this: $1,000 invested 40 years ago in the Vanguard S&P 500 ETF would have mushroomed to nearly $70,000 today. That’s the power of patience and compound interest.

At this level, tax strategy becomes your new best friend:

- Use IRAs and 401(k)s for investments that generate regular taxable income

- Keep tax-efficient investments in your regular accounts

- Do your rebalancing in tax-advantaged accounts to avoid triggering taxes

With $1,000, you can conduct your own investment orchestra by spreading money across multiple ETFs with varying risk profiles. Or consider target-date funds – they’re like having an automatic pilot adjusting your investment flight path as you near retirement.

Here’s something that might blow your mind: Take that initial $1,000 investment, add just $50 monthly, and it could grow to $461,000 over 40 years. Without those extra contributions? Around $70,000.

Your First Step Starts Here

So how much money do you need to start investing? Often, far less than people think. Whether it’s $25 a week or $1,000 upfront, the most important step is starting – not waiting.

Investing is as much an emotional journey as a financial one. Markets swing like a pendulum, but history shows that patient investors who stay the course typically come out ahead.

Our Simple Stock Guide walks you through each step of your investment journey, helping you build confidence while building wealth.

Remember, the best time to start investing was yesterday. The second best time? Right now.